(Target audience: European distributors — market overview, technical specs, standards, case studies, and partnership playbook for RisingStar high-brightness LCD displays)

Executive summary (TL;DR)

Outdoor digital displays are a fast-growing segment across retail, transport, municipal, and DOOH advertising in Europe. Success for distributors hinges on understanding brightness (nits) and optical engineering for sunlight readability, enclosure protection (IP/IK), environmental and vibration standards, thermal management and power trade-offs, longevity metrics, and demonstrable ROI for customers. This guide condenses market data, relevant European/IEC standards, engineering best practices, and deployment case guidance so you — as a European distributor — can confidently evaluate, sell, and support RisingStar high-brightness industrial LCDs to integrators and end customers. Key facts in this document are backed by industry reports and technical standards.

1. Why outdoor displays matter to European distributors (market opportunity)

The European digital signage market has been expanding steadily and is forecast to continue growing. Estimates place the Europe market value in the multi-billion USD range for the mid-2020s, driven by retail refresh cycles, transport modernization (passenger information systems), outdoor advertising (DOOH), and public infrastructure investments. This growth creates demand for rugged, sunlight readable displays that meet local standards and deliver low total cost of ownership. Recent market research projects the European market in 2025 to be in the order of USD 7–8+ billion with mid-single-digit to high single-digit CAGRs depending on the source and segmentation.

What this means for distributors:

-

There is demand across sectors (retail, transit, EV charging, fuel, outdoor advertising, municipalities).

-

Customers require technical confidence — not just price — because outdoor deployments are higher-risk (weather, vandalism, service logistics).

-

Differentiation comes from offering displays that meet European environmental and safety standards, and providing integration, service, and warranty frameworks.

2. Core technical requirements for outdoor displays (what buyers ask about)

When you qualify a lead or specify a solution, these are the core technical dimensions you must address:

2.1 Brightness & Optical Performance (nits, AR coatings, optical bonding)

-

Brightness (nits / cd/m²): Outdoor readable LCDs commonly range from ~1,000 nits (shaded/partly covered locations) up to 5,000 nits (direct sun, high-latitude summer sun glare). For full-sun visibility in direct sunlight, target ≥2,500 nits as a practical baseline; high-end kiosk, EV charging, and fuel dispensers often use 3,000–5,000 nits. Overall brightness choice should reflect site analysis (orientation, local reflectance, seasonal sun angles).

-

Anti-reflective coatings and AR films: These reduce specular reflection; combined with high luminance they improve contrast under sunlight.

-

Optical bonding (gap filling between cover glass and LCD): reduces internal reflections, increases perceived contrast, improves durability against moisture ingress and condensation.

2.2 Contrast & Color Accuracy

-

High brightness alone is not enough — perceived contrast and color saturation matter for legibility. Models with local dimming or high contrast panels, plus calibration profiles, deliver more readable content at lower power.

2.3 Thermal Management & Power

-

High brightness means heat. Effective thermal design (passive heatsinks, controlled airflow, temperature sensors, active cooling where needed) prevents brightness degradation, extends LED backlight life, and limits thermal shutdowns in hot southern European summers or enclosed kiosks.

-

Energy efficiency: LED backlight driving strategies (PWM dimming, dynamic brightness based on ambient light sensors) are essential to minimize operating cost.

2.4 Environmental Protection: IP and IK ratings

-

IP rating (Ingress Protection): For outdoor installations aim for IP54–IP65 or higher depending on exposure. IP65 is commonly recommended where rain and jets of water are expected (façades, open streets). IP54 may suffice for semi-sheltered locations.

-

IK rating (impact resistance): For public, unattended installations (bus stops, street furniture, transit hubs), consider IK08–IK10 to guard against vandalism and projectile impacts. IK10 is the most robust for high-risk sites.

2.5 Mechanical & Mounting (VESA, enclosure options)

-

Distributors should offer a range of mounting and enclosure solutions: flush wall, freestanding kiosks, pole mounts, transit-approved enclosures. Compatibility with VESA patterns simplifies field installs.

2.6 Durability & Environmental Testing (IEC standards)

-

Display systems for outdoor or transport must pass environmental testing for temperature cycling, humidity, salt spray (coastal installations), vibration and shock. IEC 60068 is the baseline collection of environmental test methods to reference; railway applications need EN 50155. Products tested to IEC 60068 (and documented) provide confidence for municipal and transport customers.

2.7 Safety, Electromagnetic Compatibility (EMC), and Certifications

-

CE marking (safety / EMC) is required in the EU; for transportation equipment EN 50155 and related EMC regimes apply. Ensure you can present test reports, declarations of conformity and related documentation for tender processes.

3. Choosing the right brightness: a practical decision tree

Selecting an appropriate brightness level is one of the first technical choices. Use this simple decision tree when evaluating site requirements:

-

Is the display indoors (atrium) or outdoors?

-

Indoors: standard 350–700 nits often suffice.

-

Outdoors: proceed.

-

Is the display fully exposed to direct sunlight (no canopy, south-facing)?

-

Yes → consider ≥2,500–5,000 nits.

-

No → shaded → 1,000–2,000 nits may be sufficient.

-

Is the display intended for long-distance viewing and advertising (DOOH billboard) or near-field information (bus stop, kiosk)?

-

Long distance: higher brightness helps visibility through reflection and competing ambient light.

-

Near field: balance brightness with contrast and anti-glare treatments.

-

Does the site have significant reflective surroundings (glass facades, snow, water)?

-

These increase effective luminance; bump brightness or use stronger AR and optical bonding.

Practical tip for distributors: include an ambient light site survey in your quoting process (handheld lux meter or smartphone lux apps plus orientation notes). Provide customers a short visual mock-up (render) comparing 1,000 / 2,500 / 4,000 nits so they see the difference.

4. Standards & certification checklist (what European integrators will request)

Below are the standards and documents you should be able to supply during tendering or technical evaluation:

-

CE Declaration of Conformity — mandatory for EU market.

-

EMC Test Reports — evidence of electromagnetic compatibility tested against applicable EN/IEC clauses.

-

Environmental Test Reports — IEC 60068 family (temperature, humidity, vibration, shock). Products tested and documented against IEC 60068 gain trust in transport and municipal projects.

-

Ingress Protection (IP) rating test evidence (e.g., IP65) — include lab certificates.

-

Impact protection (IK) certificate — IK08/IK10 where needed.

-

Railway / rolling stock standards — EN 50155 and related EMC/safety standards for railway-grade displays. If targeting transit, have EN 50155 compliance or a clear migration path.

-

RoHS / REACH compliance documentation — environmental product compliance for Europe.

-

Product lifetime & MTBF data — LED backlight life (e.g., 50,000 hours) and failure modes. (Request factory test reports.)

Distributors should maintain a "compliance pack" for each SKU: one PDF that includes the above certificates plus a product datasheet, wiring diagrams, and recommended maintenance checklist. Having this pack ready speeds tender responses and procurement cycles.

5. Deployment scenarios and technical variants

Different applications emphasize different attributes. Below are typical verticals and what they prioritize — useful when positioning RisingStar models to specific customers.

5.1 Transportation (rail, bus, tram, ferry) — priority: reliability, EN 50155, vibration, temperature

-

Typical requirements: EN 50155 compliance (where onboard), vibration testing, wide operating temperature range, anti-glare for platform displays, fast boot for emergency information systems. For outdoor timetables at platforms or stops, aim for IP65/IK08 and 2,500+ nits for unshaded sites.

5.2 Retail & Shopping Streets (window displays, façade mounts) — priority: high luminance, slim aesthetic, color performance

-

Consider video-wall capable panels that can be tiled with minimal bezels, have local dimming and content scheduling to reduce power at night.

5.3 DOOH & Advertising (billboards, stadia, high-impact placements) — priority: max brightness, remote monitoring, modularity

-

For city center or highway placements, rugged enclosures, IP66+, high refresh rate and networked CMS integration are key. Displays are often coupled with programmatic ad platforms.

5.4 Kiosks & Self-Service (EV charging, ticket vending, fuel dispensers) — priority: touch usability, vandal resistance, payment security

-

Touch sensors suitable for gloved hands, optical bonding to prevent scratches, and secure mounting to withstand tampering. IK10 where high vandalism risk exists.

5.5 Municipal & Wayfinding (parks, tourist info) — priority: low power, long life, remote updates

-

Consider energy-saving features such as ambient light adaptive brightness, low-power standby and solar-ready variants for remote sites.

6. Engineering deep-dive (design choices that matter)

This section explains the engineering tradeoffs so you can have technical dialogues with system integrators and customers.

6.1 Backlight architecture & lifetime

-

LED backlight drive: higher current yields higher nits but shortens LED life. Suppliers often specify BL MTBF (e.g., 50,000 hours). Effective thermal design and dimming strategies extend life. Provide customers with expected lifetime at projected operating brightness (e.g., 50% brightness continuous vs. 100% peak sun).

-

Power budgeting: estimate average daily energy cost = (Watt draw × hours/day × electricity rate). This helps customers calculate TCO.

6.2 Optical stack: cover glass, AR coatings, bonding

-

Hardened cover glass: for IK protection and scratch resistance.

-

AR coatings: reduce surface reflection from ~4% (untreated) to fractions of percent; layered AR + anti-smudge improves legibility.

-

Optical bonding: a silicone or resin fills the air gap; benefits include improved contrast, reduced parallax for touch, and moisture resistance.

6.3 Ambient light sensors & adaptive brightness

-

Use sensors to dynamically scale brightness based on real-time lux measurements. This saves energy while maintaining legibility and prolongs LED life.

6.4 Thermal controls & ambient extremes

-

For enclosed enclosures or southern exposures, include thermostatically controlled fans or heat pipes. Also provide cold-start strategies for -20°C and below (liquid crystal response slows at low temperatures; heaters or wide-temp LCD formulations help).

6.5 Connectivity & remote management

-

Content management: support standard CMS platforms (HTML5 players, Android/Windows signage players).

-

Remote diagnostics: report temperature, power draw, uptime, backlight health, and ambient lux. This enables SLAs and proactive maintenance.

6.6 Serviceability & modularity

-

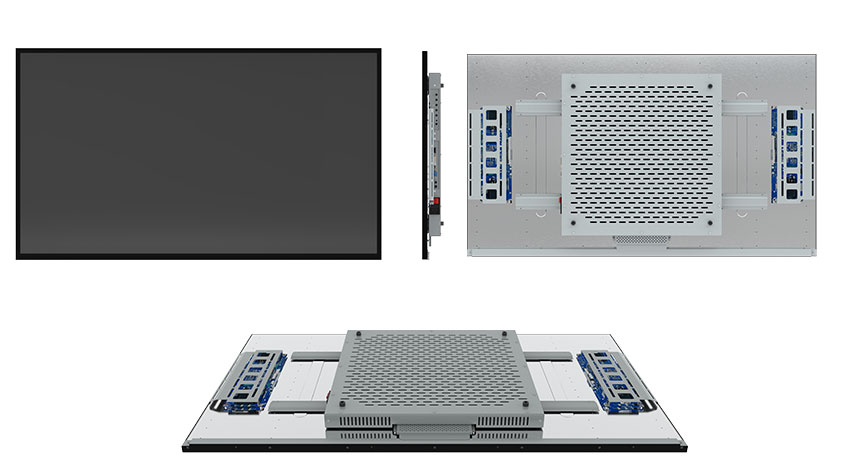

Design for field-replaceable modules: power supplies, media players, and even the LCD module where possible. This reduces downtime and lifetime service costs.

7. Case examples & lessons learned (European context)

Real deployments provide practical lessons. Below are anonymized, aggregated lessons from European projects and vendor case studies.

7.1 Transit hub timetable replacement — coastal northern Europe

Challenge: platforms exposed to rain and sea salt, wide temperature swings, high vandalism risk during festivals.

Solution highlights:

-

IP65 enclosure with stainless steel treatment and anti-corrosion seals.

-

IK10 front protection and tamper-proof fasteners.

-

EN 50155-grade power conditioning for rolling-stock applications; IEC environmental testing for temperature and humidity.

Outcome: reduced maintenance calls and clearer passenger information; vendor provided preventive maintenance contracts.

7.2 City centre DOOH campaign — central Europe

Challenge: daytime visibility competing with storefront glass and reflections; demand for premium color and contrast.

Solution highlights:

-

3,500 nits screens with optical bonding and high-end AR coatings for vivid daytime images.

-

Networked CMS with remote brightness control and ad scheduling (lower brightness at night).

Outcome: improved CPM for advertisers, measurable uplift in foot traffic for tenants.

7.3 EV charging kiosk network — multi-country roll-out

Challenge: hard to standardize installations across countries with different electrical codes and climates.

Solution highlights:

-

Modular kiosks with IP65 cabinets, wide-temp displays (−20 to +60°C), and localized power modules.

-

Standardized integration kit for payment terminals and vehicle connectors.

Outcome: faster rollouts and reduced variant SKUs; distributors offered a single-vendor integration offer.

(These examples reflect common industry patterns and public case studies.)

8. Commercial considerations & ROI arguments for European buyers

Distributors must speak business benefits as much as technical specs. Here are profitable conversation points to use in sales materials.

8.1 Total Cost of Ownership (TCO) vs. Upfront Price

-

Show TCO across a 5–7 year window: include initial CAPEX (hardware + installation), annual energy cost (dependant on brightness and duty cycle), maintenance (modules, cleanings), and replacement risk. High-quality, tested displays often have lower TCO because of longer backlight life, fewer service calls and better warranties.

8.2 Revenue uplift & measurement (for retail & DOOH)

-

Use case metrics: DOOH displays in prime daytime locations command higher ad rates if visual quality is consistently high; passenger info screens reduce perceived wait times and improve customer satisfaction metrics (use local authority KPIs where available).

8.3 Service & warranty offers — a differentiator

-

Offer extended warranties, spare parts kits, and SLA-based service packages. Distributors who bundle installation, monitoring and preventive maintenance convert more tenders.

8.4 Financing & leasing models

-

Many municipal and retail customers prefer operational expense models (lease) over CapEx. Distributors who can arrange or partner with financiers will close more deals.

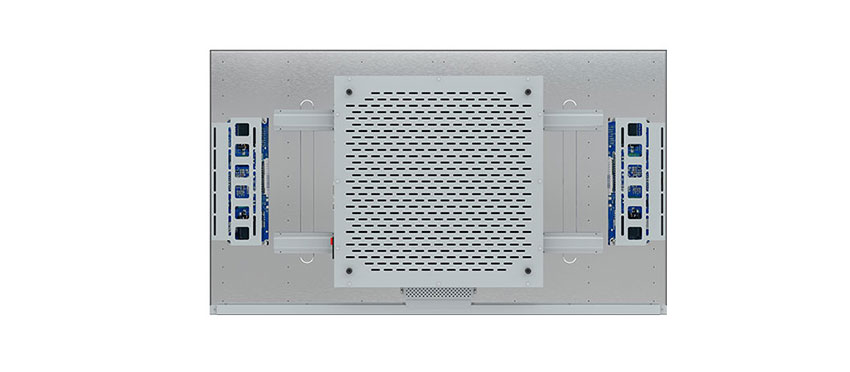

9. How RisingStar fits the European distributor proposition

RisingStar’s product line of high brightness industrial LCDs (including models up to 5,000 nits, optical bonding options, robust IP/IK variants, and industrial thermal designs) is well positioned for European outdoor signage and transit markets. To be an effective partner when representing RisingStar, distributors should:

-

Keep a stock of common sizes and popular brightness SKUs (e.g., 21.5", 27", 43", 55") to reduce lead times.

-

Request and maintain the RisingStar compliance pack for each SKU (CE, EMC, IP/IK test reports, MTBF/BL life data, IEC environmental test summaries).

-

Offer site surveys and pilot deployments (1–3 kiosks) to prove ROI with local customers before scaling.

10. Tender & procurement checklist (what to include in proposals)

When responding to RFPs or tenders, include the following sections clearly:

-

Executive summary & solution match — short, business-focused.

-

Technical datasheet per SKU — brightness, contrast, AR/optical bonding, operating temps, ingress and impact ratings (IP/IK), MTBF, warranty.

-

Compliance pack — CE, EMC, IEC 60068/EN 50155 test reports as applicable.

-

Installation plan & timeline — physical works, electrical, network.

-

Service & SLA terms — response times, spare parts, remote monitoring details.

-

TCO calculation — baseline vs. proposed solution with energy and maintenance assumptions.

-

Case studies / references — European examples or pilot results.

-

Optional extras — vandal shields, sunshades, touch upgrades, integrated media player.

11. Integration & content best practices

Distributors can add value by advising on content and integration:

-

High contrast layouts: use large fonts, high-contrast palettes for near-field legibility.

-

Adaptive content: schedule brighter content during daytime, lower brightness at night to save energy.

-

Accessibility: ensure passenger information follows legibility and accessibility guidelines (font sizes, language switching).

-

Remote diagnostics: require the CMS to report display health metrics so service teams can act proactively.

12. Common deployment pitfalls and how to avoid them

-

Under-specifying brightness — results in unreadable displays and rework. Always validate with a site orientation survey.

-

Ignoring thermal constraints — enclosures that trap heat will reduce backlight life and cause shutdowns. Use thermal simulations or vendor guidance.

-

Lack of protection — insufficient IP/IK ratings lead to water ingress and vandal damage. Match rating to exposure.

-

Poor service planning — no spare parts or local technician network leads to long downtime. Build an SLA and stocking plan.

-

Missing compliance documents during tender — delays or rejection. Maintain a compliance pack for each SKU.

13. Technical annex — quick reference tables

Note: these tables are summary guidance. Always consult the product datasheet and test reports for exact figures.

Brightness guidance (typical)

-

1,000 nits — shaded outdoor areas, covered bus stops.

-

1,500–2,000 nits — partly shaded façades, sheltered plazas.

-

2,500–4,000 nits — direct sunlight visibility for kiosks, urban DOOH.

-

4,000–5,000+ nits — full sun highway billboards or high-glare façades.

Protection ratings

-

IP54 — dust protected and splashing water; acceptable for semi-sheltered sites.

-

IP65 — dust tight and water jets; recommended for exposed locations.

-

IK08 — moderate impact resistance; suitable for many public sites.

-

IK10 — high impact resistance; for high-risk public installations.

Environmental standards

-

IEC 60068 — environmental testing suite (temperature, humidity, shock, vibration).

-

EN 50155 — rolling stock (railway) electronics requirements (use where applicable).

14. How to pitch this to a European distributor prospect — sales script (short)

Opening: “Our high-brightness LCD solutions are engineered for Europe’s harsh outdoor environments — tested to IEC environmental standards, available with IP65/IK10 options, and optimized for 2,500–5,000 nits so your customers never lose legibility in direct sun.”

Value points:

-

Lower TCO through robust thermal design and module-level serviceability.

-

Compliance pack for rapid tender responses (CE, EMC, environmental test reports).

-

Local distributor support and spare parts program.

Close: “Let us run a free site survey pilot for one busy site to prove performance and measure ad uplift / passenger satisfaction before you scale.”

15. Next steps for distributors (operational checklist)

-

Request full compliance packs and test reports from RisingStar for target SKUs.

-

Build a pilot offer including site survey, 3-month monitoring, and an SLA.

-

Prepare a local logistics & spare parts plan (one spare kit per 10–20 deployed units is common).

-

Train field technicians on module replacement and basic diagnostics.

-

Develop proposal templates that include TCO and environmental compliance evidence.

16. Final recommendations (short, actionable)

-

Do site surveys — never estimate brightness without on-site lux measurements.

-

Match IP/IK to exposure — over-spec where public vandalism or coastal salt spray exists.

-

Demand environmental test documentation — IEC 60068 or equivalent for mission-critical public installations.

-

Bundle services — installation, monitoring, and spares increase distributor margins and customer satisfaction.

-

Pilot before rollout — a small proof deployment de-risks large rollouts and provides local reference data.

References & suggested further reading (selected, authoritative sources)

-

IEC 60068 — Environmental testing standards for electrotechnical products.

-

EN 50155 — Requirements for electronic equipment on rolling stock (relevant for railway use cases).

-

Europe digital signage market reports — market size and growth context.

-

IP and IK rating guides — practical explanation of ingress and impact protection and recommendations for outdoor use.

-

Brightness guidance for sunlight readable displays (practical ranges and recommendations).

-

RisingStar product overview and sunlight readable solutions.

English

English Deutsch

Deutsch Français

Français Español

Español Italiano

Italiano 한국어

한국어 日本语

日本语 Português

Português Suomi

Suomi Dansk

Dansk Polski

Polski