A technical, market-facing guide to help European distributors evaluate, select, and sell outdoor high-brightness LCD solutions

Target audience: European distributors and channel partners.

Market focus: Europe (retail, transport, smart city, EV charging, petrol forecourts, DOOH).

Executive summary (tl;dr)

Industrial high brightness LCDs (HB-LCDs) and consumer displays may look similar at first glance, but they are engineered to serve entirely different operating envelopes and business outcomes. HB-LCDs combine specialized optical engineering (500–5,000+ nits backlights, optical bonding, anti-glare coatings), rugged mechanical and thermal design (IP66/67 enclosures, IEC/EN environmental testing, vibration resistance), and compliance/certification for sectors such as transportation and outdoor advertising. These differences translate to higher first cost but dramatically lower total cost of ownership (TCO) and better uptime in outdoor and transit deployments — the precise value propositions European distributors should sell. Market demand in Europe for digital signage and DOOH continues to grow (single-digit to low double-digit CAGR across reputable market forecasts), making now a strategic time for distributors to strengthen their HB-LCD portfolios.

1. Why this matters to European distributors

Europe’s retail, transport, and municipal buyers increasingly specify displays not just by screen size or resolution but by operational resilience and lifecycle economics. Buyers want proof a screen will remain readable in full midday sun, survive winter and summer extremes, meet local safety/EMC and rail/transport certification (where applicable), and be serviceable with minimal downtime.

As a distributor, your advantages when you offer industrial HB-LCDs:

-

Higher-margin SKUs: industrialized displays command premium pricing versus consumer panels.

-

Stickier relationships: long-term maintenance, spare parts, and CMS integration contracts.

-

B2B upsell: project services (mounting, ingress protection customization, integration).

-

Differentiation: selling technical guarantees (brightness specs, IP rating, vibration testing) that consumers cannot match.

Europe’s digital signage market size and growth make the addressable opportunity material: current reports estimate a multi-billion USD European market with steady CAGR through 2030. Distributors that can confidently discuss standards and lifecycle costs will win more tenders.

2. Core technical differences (side-by-side)

2.1 Brightness: nits and perceptual readability

-

Consumer displays: typical peak brightness 250–700 nits (good for indoor or shaded use).

-

Industrial HB-LCDs: engineered 1,000 nits (sunlight readable in shaded/indirect light) up to 5,000+ nits for direct-sun installations; some LED-based outdoor TVs and specialized signage go higher. For many direct-sun applications 5,000 nits is broadly accepted as the practical lower bound for reliable daytime readability.

Why it matters: Brightness is not only about raw nits — perceived contrast in ambient light depends on anti-reflective coatings, optical bonding (eliminating air gaps), contrast ratio, and local mounting (angle, shade). A well-bonded 2,500-nits industrial unit can outperform an unbonded 5,000-nits consumer retrofit in real world sunlight due to lower internal reflections and higher perceived contrast.

2.2 Backlight architecture and lifetime

-

Consumer: edge-lit or standard direct LED backlight optimized for indoor uniformity and cost. Typical lifetime targets set by manufacturers are often rated for comfortable indoor usage (tens of thousands of hours under controlled conditions).

-

Industrial HB: direct full-array LED backlights or specially designed high-flux LED modules with thermal management. Expect BL MTBF (mean time between failures) and rated lifetimes 40,000–70,000 hours for high-quality industrial units under specified ambient temperature ranges. Effective heat management is essential — manufacturers often include active cooling or intelligent thermal throttling to maintain color stability and extend backlight life.

2.3 Optical bonding & anti-glare

Optical bonding (liquid optically clear adhesive or OCR adhesive) removes the air gap between LCD and cover glass, reducing internal reflections, improving contrast and durability, and sealing against dust and condensation. Anti-glare coatings and low-reflection glass further reduce specular reflection from strong sunlight. These processes are routine in HB-LCDs but rare or absent in consumer TVs.

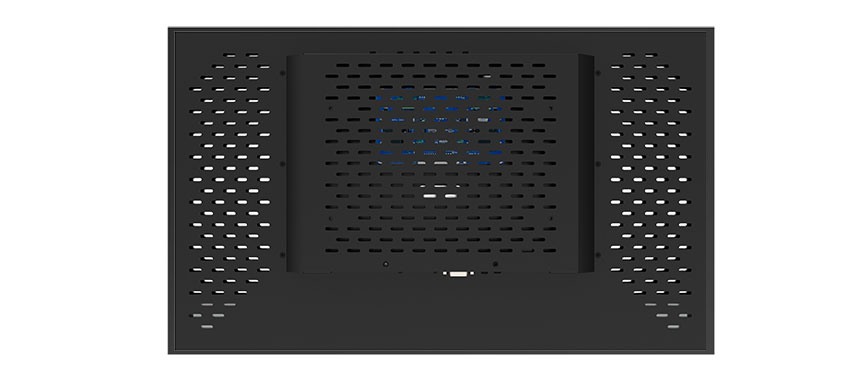

2.4 Mechanical robustness and ingress protection

-

Consumer: designed for indoor environments, not sealed to IP standards.

-

Industrial HB: sealed enclosures with IP65, IP66, IP67 or higher ratings depending on use (street-facing kiosks, pay stations, petrol forecourts). IP protection is standardized in IEC 60529 (published in Europe as EN 60529). For outdoor deployments, IP66 (high-pressure water) or IP67 (temporary submersion) are typical showstopper specs.

2.5 Environmental and vibration testing

HB-LCDs are tested against environmental test suites such as IEC 60068 (environmental testing — thermal, humidity, sand/dust) and, for transport/rail applications, EN 50155 (rolling stock, includes vibration, shock, temperature ranges). Consumer panels are not qualified to these standards. Compliance to these tests is a hard requirement for tenders in rail, metro, and many municipal projects.

2.6 EMC, safety and product standards

Industrial models are certified or designed to meet EMC and safety regulations relevant to Europe: EN 55032/55035 (EMC for multimedia equipment), IEC/EN 62368-1 (hazard-based safety for AV/ICT equipment), and local supplier requirements. These certifications materially reduce project risk in public and regulated environments.

2.7 Power management and thermal performance

Outdoor HB-LCDs place emphasis on:

-

Efficient high-flux LEDs to keep power draw reasonable at high nits.

-

Intelligent dimming (ambient light sensors or CMS-driven schedules) to save energy and reduce lifetime operating temperature.

-

Active thermal control (fans, heat pipes, intelligent throttling) to maintain color stability and protect internal electronics at high ambient temperatures.

This pays off in TCO: lower failures, less maintenance, and predictable service intervals.

3. Certifications & standards European buyers ask about (and why they’re important)

Below are the certifications and standards you’ll be asked to provide; include them in datasheets and tender responses proactively.

-

EN 60529 / IEC 60529 — IP (Ingress Protection) ratings: demonstrates resistance to dust and water; essential for any street-facing or forecourt installation.

-

IEC 60068: environmental test methods for temperature, humidity, salt spray, dust; used to validate lifetime and reliability claims.

-

EN 50155 (railway applications): rolling stock standard covering temperature, shock, vibration, power supply variability; mandatory for onboard/vehicle mounted passenger information displays.

-

IEC/EN 62368-1: safety standard for AV/IT equipment — required for market acceptance and to satisfy procurement safety checks.

-

EMC standards (EN 55032/55035): electromagnetic compatibility to avoid interference with other equipment — particularly important in transport and critical infrastructure.

-

ISO 16750 (where vehicle mounting is considered), and relevant national/local safety and fire regulations (e.g., EN 45545 for fire protection in railway applications where applicable).

Sales tip: create a one-page “compliance snapshot” that maps your product SKUs to each standard (status: certified / test report available / design to standard). This document is a quick trust builder for technical procurement teams.

4. Real-world performance metrics distributors should demand from vendors

When qualifying HB-LCDs for your catalogue, ask for — and validate with datasheets/test reports — these concrete metrics:

-

Sustained luminance (nits) at 25°C and at max operating temperature (e.g., “5,000 nits ±10% at 25°C, sustaining 3,000 nits at 55°C”).

-

Contrast ratio measured with optical bonding in place (not just panel native).

-

Optical bonding method and AR coating specifications (material, haze, reflectance %).

-

Ingress rating (IPxx) with measured ingress test reports.

-

Thermal cycle & humidity test reports (IEC 60068 results).

-

Vibration and shock test reports (particularly for transit/rail).

-

Backlight life (BL MTBF or L70/L50 hours at specified ambient temperature and brightness).

-

EMC & safety certificates (EN 55032/62368 test reports).

5. Case studies & sector examples (European context)

5.1 Transit and passenger information systems

European transport authorities have been steadily migrating to digital passenger information systems (PIS) across regional rail, metro, bus interchanges, and airports. Projects commonly require EN 50155 compliance for onboard equipment and IP66-rated outdoor displays for stations and platforms. Examples include station rebranding and live status screen upgrades on UK Underground projects and multiple European bus station digitalization projects (case examples published by signage integrators and manufacturers).

Why HB-LCDs win in transport: predictable readability under varied lighting (platform skylights, winter low sun), certified vibration/shock resistance, and long service windows aligned with procurement lifecycles.

5.2 Retail, forecourts and EV charging kiosks

Outdoor retail signage and EV charging stations require displays that remain legible in direct sunlight, resilient to fuel vapors or outdoor exposure, and manageable for maintenance crews. Many kiosk owners now prefer integrated HB-LCD modules with optical bonding and IP6x enclosures to reduce customer complaints and maintenance visits. Case studies from parking and retail DOOH operators across Europe demonstrate higher CPM and engagement when outdoor displays are readable day-and-night.

5.3 DOOH and advertising networks

DOOH operators in Europe (e.g., big operators and programmatic platforms) deploy a mix of LED billboards and HB-LCDs depending on location, viewing distance, and content type. For street level, kiosk and bus shelter installations, HB-LCDs with 1,000–3,000 nits remain common; for direct sun and premium out-of-home panels, 5,000+ nits units are used. Successful DOOH case studies show that deployers that specified industrial HB-LCDs saw fewer site failures and smoother contractual performance obligations.

6. Quantifying TCO: why initial price ≠ lifetime cost

A key part of the distributor pitch is explaining TCO:

-

Upfront cost: industrial HB-LCDs are typically 2–4× the price of consumer panels of the same diagonal when prepared for outdoor use (bonding, enclosure, backlight engineering).

-

Operating costs: energy (brightness), replacement parts, and maintenance. Intelligent dimming and efficient LEDs reduce energy spend; sealed enclosures reduce frequency of service visits.

-

Failure and downtime costs: in a public transport or DOOH contract, failure penalties and lost ad revenue can far exceed the extra upfront cost of industrial displays. Case evidence from operators shows that devices engineered for outdoor conditions reduce unplanned maintenance and contractual deductions.

Example TCO comparison (illustrative)

-

Consumer retrofit: €3,000 unit, 2 service calls/year on average, 5-year replacement interval → higher downtime risk and hidden costs.

-

Industrial HB-LCD: €9,000 unit, 0.5 service calls/year, 8–10 year lifecycle → lower net present cost when accounting for revenue uptime and penalty avoidance.

(Note: distributors should run site-specific TCO models; the numbers above are illustrative — actual vendor quotes and utility rates will change the result.)

7. Technical due diligence checklist for distributors

When evaluating new HB-LCD suppliers, run this checklist and request evidence for each item:

-

Brightness & thermal derating — measurement reports at 25°C and at maximum operating temp.

-

Optical bonding & AR specs — technical description, bonding process, and reflectance numbers.

-

Ingress test reports — IP verification documents to EN 60529.

-

Environmental testing — IEC 60068 test matrix and results.

-

Rail/vehicle compliance — EN 50155 or ISO 16750 where applicable.

-

EMC & safety certificates — EN 55032/62368 certificates.

-

Power specs & dimming options — peak, typical, sleep mode power draw and ambient sensors supported.

-

Warranty & RMA policy — details on depot repair versus swap-out, spare parts availability in EU.

-

Serviceability — modular replacement of power/backlight/LCD modules; local service partners in EU.

-

Case studies & references — at least two EU references for similar installations, preferably with contactable integrators/owners.

8. Commercial playbook: how to pitch HB-LCDs to European buyers

8.1 Value messages that resonate

-

“Guaranteed daylight readability” — back with measured nits + bonding + reflectance numbers.

-

“Designed for your operating environment” — cite IP rating, temperature range, and vibration testing.

-

“Lower downtime & predictable costs” — show TCO comparison and warranty terms.

-

“Compliance with EU safety and EMC rules” — provide the compliance snapshot.

-

“Local service & stocking” — highlight EU spare parts warehousing and fast swap options.

8.2 Commercial structures

-

Distributor margin model: OEM wholesale → distributor margin on hardware + integration fees. Negotiate volume discounts tied to forecasted rollouts.

-

Project bundles: offer hardware + CMS onboarding + 3-5 year service contracts — these reduce buyer risk and increase recurring revenue for you.

-

Finance options: partner with leasing providers for ad operators and municipalities to reduce procurement friction.

8.3 Early objections and rebuttals

-

Objection: “Too expensive.” → Rebuttal: present a TCO analysis showing the amortized cost per uptime hour; highlight revenue preservation in DOOH and fines avoidance in regulated transport tenders.

-

Objection: “Consumer screens look similar.” → Rebuttal: explain optical bonding, IP, certifications, and provide lab reports illustrating performance gaps.

9. Integration & installation considerations (practical advice)

-

Mounting & ventilation: outdoor enclosures must integrate thermal dissipation without compromising IP rating — choose mounting designs that permit heat transfer (heat sinks, conduction paths) while preserving sealing.

-

Sun/shade analysis: specify mounting orientation and estimate direct sun exposure hours; this determines required peak nits and cooling strategy.

-

CMS & network: ensure the display supports standard CMS protocols (e.g., HTML5 signage players, RS-232/485, SNMP or vendor APIs) and that network security meets EU procurement requirements.

-

Service access: plan for swap-out access (rear, front or service door) and secure fast spare pool inventory in Europe to minimize Mean Time To Repair (MTTR).

-

Power & surge protection: outdoor sites need surge protection and earth grounding standards meeting local codes.

10. Practical labelling & datasheet language (examples you can reuse)

When you prepare product pages or tender documents, use precise phrases backed by test references. Example lines:

-

“Rated 5,000 nits peak luminance (measured per manufacturer test method at 25°C). Test report available on request.”

-

“IP66 sealed front face; IP65-rated ventilated enclosure (IEC/EN 60529 test reports available).

-

“Design implemented to IEC 60068 environmental testing profiles (high humidity, salt spray option) — sample test report available.”

-

“EN 50155 tested variant available for rolling stock applications (shock & vibration tested).”

-

“Optically bonded glass with <2% total reflectance; increased contrast in direct-sun applications.

11. Market sizing & opportunity (concise view for distributors)

Europe’s digital signage market is measured in multiple billions USD and projected to grow at a healthy CAGR through 2030. Growth is driven by retail upgrades, transport digitalization, DOOH programmatic expansion, and infrastructure modernization (EV charging, smart city rollouts). As operators prioritize reliability and measurable uptime, industrial HB-LCDs are a rising share of outdoor and transit installations. This trend favors distributors who can supply certified industrial displays and value-added services.

12. Technical deep dive: engineering features that make the difference

12.1 Optical engineering — how brightness and readability are earned

-

Panel transmittance: the fraction of backlight passing through LC cells — industrial panels often use specialized optics to maximize this.

-

Backlight flux vs. heat: increasing LED flux raises temperature; engineering must pair LEDs with heat sinks and thermal control to avoid color shift and reduced lifetime.

-

Optical bonding: reduces Fresnel reflections from the air-glass interface — typical reflectance improvement is dramatic (from 8–10% to <2–3%), yielding much higher perceived contrast under sunlight.

12.2 Thermal & power design

-

Active thermal control: thermostatically controlled fans or Peltier/heat pipe assemblies in extreme climates.

-

Dimming control: automatic luminance scaling based on ambient sensor to extend lifetime and reduce power costs.

-

Power supplies: wide input range and protections against surges — important at forecourts and outdoor cabinets.

12.3 Mechanical design for durability

-

Aluminium extrusions and reinforced frames for rigidity and lighter weight while maintaining thermal conduction.

-

Seals & gasketing bonded per IP test procedures.

-

Vibration mounts and potting of certain electronics for rail/vehicle use (per EN 50155/ISO 16750 practices).

13. Partnering and go-to-market recommendations (for distributors)

-

Build a compliance pack: datasheet + certificate snapshot + test report excerpts + two EU case references.

-

Localize offering: stock spare modules in EU warehouses; offer installation training to local integrators.

-

Create project bundles: hardware + CMS + 3-year service + spare pool — pitch to municipal and transport tenders.

-

Educate sales teams: train field sales on difference between consumer LED and HB-LCD metrics; use lab videos and demo units outdoors to show the difference.

-

Target verticals first: rail/transport and forecourts tenders (regulated, higher margin) — then expand to retail and DOOH. Case studies show early wins in transport often unlock broader city/municipal projects.

14. Sample technical rebuttal document for procurement (one-page)

(Include this with bids to answer “why not cheaper consumer screens?”)

-

Readability: 5,000 nits + optical bonding → measurable contrast under direct sunlight (test report ref. #).

-

Durability: IP66 enclosure + IEC 60068 environmental tests (temperature/humidity/salt spray).

-

Compliance: EN 50155 variant available for rail; IEC/EN 62368-1 safety; EN 55032 EMC test reports on file.

-

TCO: fewer service calls, longer lifetime, predictable replacement schedule — sample TCO attached (annex A).

-

Warranty & service: 3-year standard warranty, optional 5-year extension, depot swap options from EU stock.

15. Frequently asked technical questions (with concise answers)

Q: Do I always need 5,000 nits for outdoor?

A: Not always. 1,000–3,000 nits can work in shaded or partially covered sites. Direct midday sun and reflective urban canyons typically require 5,000 nits or higher plus optical bonding. Use a sun-exposure analysis per site.

Q: How long do high brightness backlights last?

A: High-quality industrial LED backlights are rated 40,000–70,000 hours (L70 or BL MTBF depending on vendor), but lifetime depends on operating brightness and thermal environment. Request vendor L70 at rated operating temperature.

Q: Are LED billboards better than HB-LCDs for DOOH?

A: It depends on viewing distance and content type. LED is dominant for large format, long-range billboards. HB-LCDs perform well for close-to-eye kiosks, transit displays, and smaller street furniture where pixel density and legibility for small text/images matter.

16. Closing — what European distributors should do next (practical checklist)

-

Select 2–3 HB-LCD SKUs covering: (a) transit/EN50155 variant, (b) IP66 street-facing kiosk (3,000–5,000 nits), (c) low-power 1,000–2,500 nits unit for shaded urban DOOH.

-

Obtain compliance packs from manufacturers (IP/IEC/EN test reports).

-

Pilot one local project (bus station, EV charging kiosk, or mall outdoor concourse) with full data collection (uptime, energy use, readability feedback). Use pilot as a reference.

-

Train your technical sales team with lab footage and field demos showing bonded vs non-bonded panels under direct sun.

-

Bundle service and spare pool offerings to turn one-off hardware sales into recurring revenue.

17. Appendix — selected authoritative references & further reading

-

IEC IP code / EN 60529 (Ingress Protection).

-

IEC 60068 environmental testing series overview.

-

EN 50155 railway electronic equipment standard (rolling stock).

-

IEC/EN 62368-1 safety testing and certification for AV/IT equipment.

-

Optical bonding technical overview (benefits for sunlight readability).

-

Practical guidance on required luminance for outdoor readability (industry summary).

-

Europe digital signage market reports (Grand View Research, Mordor Intelligence, DataBridge Market Research).

-

European transit and DOOH case study examples

English

English Deutsch

Deutsch Français

Français Español

Español Italiano

Italiano 한국어

한국어 日本语

日本语 Português

Português Suomi

Suomi Dansk

Dansk Polski

Polski