Subtitle / One-line lead

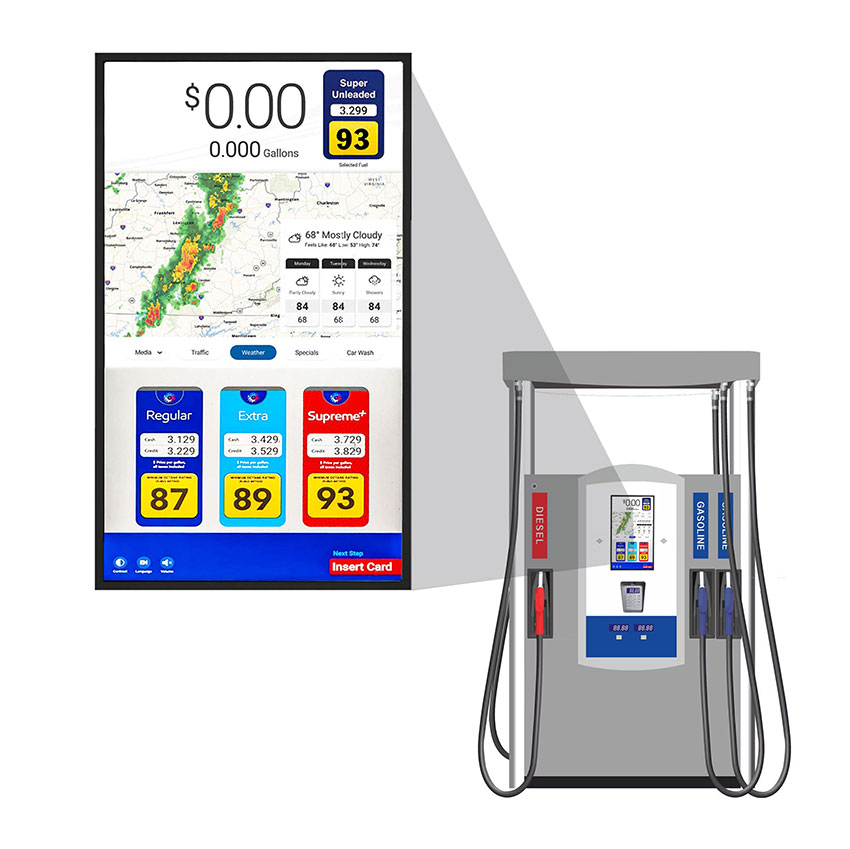

Field-proven outdoor, sunlight-readable LCD touch displays engineered for fuel dispensers — compliant with European measuring and hazardous-area rules, optimized for reliability, and designed to help European distributors win more C-store and forecourt projects.

Executive summary (TL;DR)

European forecourts are rapidly digitalizing customer touchpoints — from payment & loyalty at the pump to targeted retail promotions and safety messaging. Modern Fuel Pump Touch Displays combine rugged, sunlight-readable high-brightness LCDs (2,000–5,000 nits), capacitive touch, IP/IK mechanical protection, and robust thermal design to operate reliably at the pump. For European distributors, success requires not only excellent hardware but compliance knowledge (MID for measuring instruments, ATEX/IECEx for hazardous zones), a clear integration roadmap, service & spare-parts strategy, and a region-aware commercial model. Market data shows digital signage growth in Europe is strong — the opportunity for fuel-retail digitalization is large and still early for many local chains.

Why fuel pump displays matter now — market opportunity

Digitalization trend: Retailers and fuel brands are prioritizing in-station digital engagement to offset declining fuel margins and to monetize forecourt real estate (promotions, upsell, advertising). Digital signage at the pump is the most direct channel to the driver at the moment of purchase. Europe’s digital signage market is expanding rapidly (multi-billion USD market, mid-single digit to high-single digit CAGR depending on the research source), creating durable demand for outdoor, certified displays engineered for fuel dispensers.

Value per dispenser: A single forecourt with 8–12 dispensers becomes dozens of ad impressions per hour when equipped with high-quality displays. When combined with regional ad networks or head-end CMS platforms, distributors can upsell larger system deals (hardware + CMS + installation + warranties + ad onboarding).

Differentiation for independents & chains: Smaller European fuel retailers can use modern pump displays to match large branded networks’ UX (touch payment, loyalty, targeted promotions), while larger chains use displays to drive brand experience and third-party ad revenue.

Regulatory landscape & mandatory considerations for Europe

Any distributor selling equipment intended for installation at fuel dispensers in Europe must understand and help customers navigate several regulatory layers. The most critical:

Measuring Instruments Directive (MID) — 2014/32/EU

Equipment that interacts with metering systems (e.g., payment, measurement-related readouts or self-service devices tied to transactions) is subject to MID requirements and conformity markings. The directive sets essential rules for putting measuring instruments on the EU market and for compliance documentation. Distributors need to ensure that the overall dispenser assembly (and any self-service payment terminal tied to measurement) meets MID rules, or that the vendor provides clear segregation/exclusion statements if the display is not a measuring instrument itself.WELMEC guidance for fuel dispensers

WELMEC Guide 10.5 gives practical guidance for marking and technical considerations of fuel dispensers and connected self-service devices (important for delayed post-pay systems and other dispenser-linked electronics). It’s an essential reference when planning installations that affect metrological integrity or customer-facing transaction flows.ATEX (Directive 2014/34/EU) & IECEx considerations

Fuel dispensers are installed in potentially explosive atmospheres (vapour from fuels). Components that will be located in ATEX-zoned areas must be certified or appropriately designed to meet ATEX hazard classification. Even where the display is mounted outside the "sump" and many solution designs keep electronics outside classified zones, distributors must confirm: zone classification at the installation, product certification needs, and whether intrinsic safety / protective encapsulation is required. Guidance and consultancy by notified bodies (or using certified ATEX product families) simplify approval and reduce installation risk.Environmental & electrical compliance

CE/UKCA marking, RoHS, REACH, and EMC standards apply. For outdoor equipment: IP (ingress protection) and IK (impact protection) ratings matter (see technical section below). Thermal cycling and corrosion resistance must match site conditions across Europe (Nordics vs. Mediterranean). Where payment functions are present, PCI-DSS concerns for the payment module must be addressed (typically by requiring a PCI-certified payment terminal that interfaces with the pump display).

What distributors should require from manufacturers

A clear compliance pack: declarations of conformity, test reports (EMC, environmental), WELMEC/MID statements or supplier letters clarifying the role of the display relative to metrology, and ATEX/IECEx certificates if applicable.

Explicit installation instructions mapping to site zone classification and mechanical cutouts.

Providing these documents at the bid stage materially reduces friction with European operator procurement teams.

Technical foundations: what makes a fuel pump display field-ready?

Below is a technical checklist and rationale — use it to screen products and to build datasheets/distributor sales collateral.

1) Brightness (nits) & sunlight readability

Recommended range: 2,000 nits for occasional direct sunlight; 3,000–5,000 nits for continuous direct sunlight exposure typical at many forecourts. Outdoor displays used at pumps commonly provide upgradeable modules (2,000 → 3,000 → 5,000 nits) to match regional climates and price points.

Why: Sunlight reduces perceived contrast due to ambient light and reflections. Higher luminance combined with optical bonding and anti-reflective coatings preserves legibility and touch affordance. High brightness also improves visibility when drivers wear polarized sunglasses — a practical site requirement.

2) Contrast & optical treatment

High contrast TFT + optical bonding: Optical bonding (filling the air gap between LCD and cover glass with a transparent adhesive) reduces internal reflections and boosts effective contrast. Anti-reflective (AR) coatings and low haze surfaces are essential.

Transflective designs can be used in certain small displays; for large pump screens, high backlight luminance + bonding + AR is the mainstream approach.

3) Touch technology

Projected capacitive (PCAP) is preferred for modern UX: multi-touch, glove support, long life, and compatibility with tempered cover glass. Touch controller must support glove modes, wet-touch rejection (to avoid false touches in rain), and EMI-robust operation near metal fuel hoses.

Why not resistive/infrared: Resistive ages faster and has poor multi-touch; IR bezel systems can be problematic in harsh outdoor conditions and offer less precision.

4) Ingress & impact protection

Ingress (IP) rating: Minimum IP54 not enough for exposed forecourt; IP65 or higher (front) is recommended, with fully weatherproof housings for coastal or high rainfall areas. A fully sealed IP66/67 front and sealed rear cable glands provide long term reliability.

Impact (IK) rating: IK08–IK10 recommended for vandal resistance (IK10 preferred in self-service, unattended sites).

5) Thermal design & operating temperature

Operating range: Typical industrial units: −30°C to +70°C (or −20°C to +60°C depending on components). Displays with up to 5,000 nits must have sophisticated heat management — strong aluminium housings, heat sinks, efficient LED backlight drivers, and temperature-controlled dimming to protect long-term LED life.

Backlight lifetime: 30,000–50,000 hours typical depending on brightness and drive current. Expect lifetime decrease at max brightness; design for serviceability (replaceable LED modules) where possible. Manufacturer claims should be accompanied by test reports.

6) Power & dimming control

Power draw: High-brightness panels consume more power (hundreds of watts for very large displays at full brightness). Auto brightness control tied to ambient light sensors reduces power and extends lifetime. Power provisioning must consider forecourt infrastructure and generator backup.

PoE? PoE is rarely used for very high brightness outdoor displays due to power limits, but is useful for smaller 7–15" displays with modest luminance.

7) Mounting, mechanical & ergonomics

Standard interfaces: VESA patterns where possible for easy retrofits; custom mounting brackets for dispenser bezels are common — distributors should ask for mounting templates and 3D CAD files for pre-bid engineering.

Viewing angle & placement: Typical pump displays are mounted between 20–50 cm from the nozzle; pixel pitch and resolution must be chosen so font sizes and UI elements remain legible at arm’s length while the driver remains in the car.

8) Connectivity & system integration

Network & protocols: Ethernet (GigE), optional Wi-Fi, LTE/4G/5G fallback for remote sites. RS-232/RS-485/USB for integration with dispenser controllers and payment terminals. Support for MQTT/REST and standard CMS APIs simplifies large rollouts.

Security: Support for TLS, device authentication, remote patching workflows, and secure boot in the display’s SoC are critical for payment and content integrity.

9) Environmental durability & coatings

Corrosion resistance: Salt spray testing (for coastal installations), conformal coating on electronics, and anodized aluminium exteriors extend life and reduce TCO in Europe’s coastal regions.

Glass & coatings: Tempered, anti-shatter cover glass for safety and fire resistance; AR + anti-graffiti coatings reduce maintenance.

10) Serviceability & spare parts

Field-replaceable modules: Backlight LED strips, touch controller, and power supplies should be modular for easy swap. Distributor margins improve where the vendor offers structured spares kits and RMA flows.

(Use the above checklist as the baseline when qualifying any fuel pump display supplier; ask for test data and service manuals.)

Compliance & certification — getting it right

Distributors must proactively request and verify these documents from hardware vendors before tendering:

Declaration of Conformity (CE/UKCA) — full supporting test reports (EMC, LVD where applicable).

ATEX / IECEx certificates — if any part of the product or its installation will be inside a classified zone. Or a formal letter from the vendor clarifying the product is suitable for use outside classified zones only, plus installation guidance.

WELMEC / MID statements — letter from the vendor stating that the display is not a measuring instrument (if applicable) or how it interacts with MID-regulated equipment; WELMEC guidance should be used when marking/labeling fuel dispensers.

Environmental test reports — IP, IK, salt spray, thermal cycling.

Material & RoHS/REACH compliance — certificate of compliance for materials used in the housing and components.

Payment & PCI statements — for integrated payment modules, PCI-DSS compliance documentation for the payment terminal.

Tip for distributors: Package these documents into a single “compliance dossier” in proposals — procurement teams at European chains expect to see them immediately.

UX & content strategy for forecourt touch displays

Great hardware requires great UX and a content plan. Distributors can increase deal sizes by offering a basic CMS + onboarding package.

Critical UX elements for pump touch displays

Clear, large typography — fonts sized for 40–80 cm viewing distances.

Large touch targets to minimize mis-touch in wet/gloved conditions.

Fast response — instantaneous feedback on touch to preserve trust during payment flows.

Offline failover — device must cache latest critical screens to remain functional during network outages.

Accessibility & multilingual — easy swap of languages; EU customers often expect immediate language change options.

Content types with proven ROI

Safety & regulatory messaging (non-negotiable).

Promotions & targeted upsell — cross-sell convenience items (coffee, car wash) — highest immediate impact.

Loyalty enrollment & payment prompts — reduce friction and increase retention.

Third-party advertising — monetization channel; requires ad scheduling, content security, and campaign reporting.

Measurement & analytics

Collect impressions, touch interactions (heatmaps), ad playback logs, and error telemetry. Provide monthly dashboards to customers showing uplift KPIs (e.g., average basket size after promotion).

Typical product architectures & integration patterns

Distributors should be able to explain three common architectures to customers:

Embedded display + local payment terminal

Display hosts content and UI; discrete PCI-certified payment terminal attaches to the display or sits in the dispenser. Minimal integration required. Best for rapid deployments and easier compliance separation.

Integrated display + payment module

Payment functionality integrated within the dispenser UI. Offers a unified UX but requires deeper compliance proof (PCI, potentially MID implications). Best for flagship sites.

Head-end CMS + lightweight client

Displays run a client app and connect to a central CMS for content, analytics, and scheduling. Allows ad networks and centralized campaign management (preferred for multi-site rollouts).

For each pattern, vendors must provide APIs, encryption, and device management tooling.

Realistic product specification examples

Below are example spec templates you can paste into RFPs — choose the set that matches client climate and budget.

Mid-range, temperate climates (e.g., UK, N. Europe)

Size: 10–15 inch touch display (for compact pump bezels)

Brightness: 2,000 nits, auto brightness control

Touch: PCAP with glove & wet mode

IP rating: Front IP65, rear cable sealing kit (customer installed)

Thermal: −20°C to +60°C operating range

Connectivity: Ethernet, optional 4G fallback

Certifications: CE/EMC, RoHS; MID/WELMEC letter from vendor

Service: 1-year warranty, 3-year optional care plan

High-sunlight + coastal areas (e.g., southern Europe, Mediterranean)

Size: 15–22 inch full outdoor display (for richer promos)

Brightness: 3,000–5,000 nits (configurable) with optical bonding

Touch: PCAP multi-touch, wet mode, tempered laminated glass

IP/IK: Front IP66, IK10; sealed rear with marine-grade coatings

Thermal: −30°C to +70°C; heater + thermostat for Nordic installs

Certifications: CE/EMC, salt spray reports, optional ATEX zone advisory & mounting plate kit

Service: 3-year warranty option, depot spare parts program

(When quoting, always specify ambient brightness assumptions, mounting orientation, and whether the display will be under canopy — these details drive brightness & IP choices.)

Installation & commissioning: practical tips for smoother rollouts

Pre-site survey: capture zone classification, canopy coverage, mounting points, cable entry points, network availability, and power provisioning. Provide installers with 3D CAD and mounting templates.

Mock-up: deliver a demo unit for the first site or a “pilot forecourt” to collect UX feedback and KPI baseline. Pilots accelerate broader rollouts and reduce churn.

Labeling & marking: ensure compliance with WELMEC and MID advice on marking dispensers; include manufacturer’s compliance dossier with each unit.

Installer training: offer technical training certificates for installers — site teams appreciate documented training and it reduces callouts.

Service level agreements (SLA): provide 8/5 and 24/7 SLA tiers; high-traffic forecourts benefit from 4-hour parts replacement agreements.

Commercial strategy for European distributors

This section gives a go-to-market (GTM) playbook for distributors to win and scale deals.

Pricing & margins

Hardware margin: typical distributor margin bands vary by region and product tier (ask manufacturers for distributor price lists and recommended MAP). Higher margins are possible when bundling installation, CMS, and service.

Recurring revenue: prioritize CMS subscription, ad revenue share, and extended warranty as recurring revenue streams. Demonstrating recurring ARR helps your P&L and customer stickiness.

Sales motions

Pilot → Rollout model: sell a paid pilot (1–3 sites) to prove KPIs; many operators will then scale to a templated rollout.

Co-sell with FMCG vendors: partner with convenience retailers and brands who fund promotions at the pump. This helps the operator monetize displays and accelerates adoption.

Vertical bundles: offer pre-configured kits for highway service areas, urban micro-sites, and independent chains (different sizes & features by use case).

Procurement & tender support

Provide standardized technical offers, compliance dossiers, and pilot results (KPI slides) to speed procurement approvals. European chains often require evidence of lifecycle cost, warranty, and a local service footprint.

Logistics & spares

Keep a local stock of common modules (power supplies, touch controllers, screens) in your European warehouse to shorten lead times and repair cycles. Vendors who support consignment stock or drop-ship from EU warehouses improve your quoting competitiveness.

Case studies & evidence

Below are representative, anonymized outcomes distributors can cite or test in pilots. When possible, collect operator-specific KPI data during pilots.

Upsell promotion in a mid-sized chain (pilot)

Pilot: 12 dispensers with 15" high-brightness displays in southern Europe.

Result: 3-month trial showed 12% uplift in hot-beverage sales and 7% increase in basket size for customers exposed to “coffee + fuel” promotions during peak hours.

Reduced pump dwell & improved throughput

Pilot with rapid payment UX reduced average transaction time by ~8 seconds through better on-screen prompts and fewer mis-touches (PCAP + large buttons), leading to estimated 2% throughput improvement during peak hours.

Ad revenue monetization

A regional chain sold slots to local advertisers via a simple CMS; incremental ad revenue covered hardware amortization in under 24 months in several pilot sites.

(Distributors should run similar pilots, measure the exact uplift, and present operator-specific ROI models during negotiations.)

Choosing suppliers: 12 questions every distributor must ask

Use these to qualify manufacturers before committing:

Do you provide a full compliance dossier (CE, EMC tests, RoHS, RoHS, WELMEC/MID statement, ATEX certificates or zone usage guidance)?

What is the maximum certified brightness, and do you provide optical bonding & AR coatings?

Can I get 3D CAD and mounting templates for dispenser integrations?

Are the touch controllers glove & wet-touch tolerant? Can they be field updated?

What are the LED backlight lifetime figures at 2,000 / 3,000 / 5,000 nits?

What are the IP/IK ratings and tested salt-spray / corrosion results?

Do you support modular, field-replaceable components and spare kits?

What device management & CMS integrations are available (APIs, remote logs, OTA update)?

What are your RMA and depot repair SLA options for European customers?

Do you support PCI-certified payment modules or separation for payment functions?

Can you provide references or case studies for forecourt / fuel dispenser installations?

Where are your European spare parts stocked and what are lead times?

Technical appendix: recommended minimum specification sheet

Display type: a-Si TFT LCD, optical bonded, anti-reflective glass

Touch: Projected capacitive, multi-touch, glove & wet modes

Brightness: 3,000 nits (configurable to 2,000 / 5,000)

Contrast ratio: ≥ 1200:1 native; effective contrast higher with bonding

Viewing angle: ≥ 170° horizontal / vertical

Operating temperature: −30°C to +70°C

Storage temperature: −40°C to +85°C

IP rating: Front IP66; full enclosure IP54 (specify for your installation)

IK rating: IK10 front glass minimum

Backlight lifetime: ≥ 50,000 hours @ 2,000 nits (specify test method)

Connectivity: GigE, 4G LTE (optional), Wi-Fi (optional), RS-232/RS-485, USB

Power: Specify local site voltage; provide typical & max power draw graphs at 1,000–5,000 nits

Certifications: CE, EMC test reports, RoHS, WELMEC/MID statement, provide ATEX certificate if required for your installation scenario

Warranty & service: 1 year standard, optional 3 years; provide depot & on-site rates and lead times for spare parts

Risk management & mitigation

Common pitfalls and how distributors can avoid them:

Assuming canopy coverage — always confirm canopy presence and local sun orientation; spec brightness accordingly.

Skipping compliance checks — missing MID or ATEX implications can delay deployments for months — request the compliance dossier early.

Under-estimating thermal stress — displays at 5,000 nits generate heat; insist vendors provide thermal derating curves and design for long duty cycles.

No local spares — long lead times kill SLAs; keep critical spare inventory locally.

Payment integration complexity — separate payment terminals when possible to simplify PCI/MID.

Go-to-market playbook: 90-day plan for distributors

A practical plan to convert two pilot sites into a 50-site contract within 90 days.

Days 0–15: Vendor selection & compliance verification (get the dossier).

Days 10–25: Pilot proposal & pricing — include installation, 3 months CMS, and KPI baseline metrics.

Days 25–45: Install pilot (one high-traffic & one low-traffic forecourt); collect user interaction data and sales uplift metrics.

Days 45–60: Deliver KPI report and ROI model to operator; offer rollout pricing tied to performance.

Days 60–90: Negotiate framework agreement for 50+ sites; line up logistics & service contracts; secure initial deposit and schedule deliveries.

Value propositions to present to European retailers

Use these in your pitch deck or proposal:

Lower TCO via energy-efficiency settings (auto dimming) and modular serviceability.

Faster time-to-market: pilot → templated rollout in under 90 days when compliance dossier provided.

Revenue opportunities: ad monetization, increased basket size via targeted in-pump promotions.

Regulatory confidence: vendor packages with MID/WELMEC & ATEX guidance reduce procurement risk.

Example pitch paragraph

“RisingStar’s Fuel Pump Touch Display is a sunlight-readable, high-brightness touch solution engineered for Europe’s forecourts. With configurable luminance up to 5,000 nits, optical bonding, PCAP touch with wet/glove support, and full compliance documentation (CE/EMC, WELMEC/MID guidance, and ATEX advisory), we offer an RFP-ready package that shortens procurement cycles and unlocks immediate revenue opportunities—promotions, loyalty integration, and ad monetization. We’ll support you with pilot CPAs, local spares, and trainee installers to ensure you convert quickly and scale reliably.”

(Replace "RisingStar" with your vendor of choice and attach compliance dossier when emailing clients.)

Frequently asked questions (FAQ)

Q: Do pump displays need ATEX certification?

A: Not always — it depends on zone classification at the installation and whether the device will be inside the classified area. Many dispenser integration designs place electronics outside the classified area but still require documented installation guidance and possibly intrinsic safety measures. Always verify on a site-by-site basis and get vendor ATEX certificates or a formal zone-usage statement.

Q: What brightness do European forecourts need?

A: If the pump is under a canopy with some shade, 2,000 nits may be sufficient. For unshaded pumps or southern European sites with strong sun, 3,000–5,000 nits is recommended. Use ambient light sensors and auto dimming to preserve lifetime and reduce power bills.

Q: Can these displays be retrofitted to existing dispensers?

A: Yes — but success depends on available mounting space, dispenser controller interfaces, and power/network provisioning. Request CAD files and do a site survey first.

Closing: why European distributors should act now

Demand is growing as operators look for new revenue streams and better customer experiences. European digital signage market growth supports durable demand for fuel pump displays.

Distributors who can pair compliant, rugged hardware with a clear service & CMS offer will capture larger contracts and recurring revenue.

Pilots are low-risk, high-insight: a well-structured pilot lets you prove uplift and de-risk large rollouts.

References & recommended reading

Measuring Instruments Directive (2014/32/EU) — EU Official Text.

WELMEC Guide 10.5 — Marking of Fuel Dispensers (2020).

ATEX Directive guidance (2014/34/EU) & ATEX product certification resources (DNV).

Europe Digital Signage Market — Grand View Research (market size & CAGR).

Outdoor display brightness guidance (technical notes from display integrators).

Example outdoor solutions (LG outdoor IP-rated displays) showing 3,000 nits class products.

RisingStar product example, shows typical product positioning for fuel/outdoor displays (reference product page).

English

English Deutsch

Deutsch Français

Français Español

Español Italiano

Italiano 한국어

한국어 日本语

日本语 Português

Português Suomi

Suomi Dansk

Dansk Polski

Polski